80. A Long-Lived, Heterogeneous Agent, Overlapping Generations Model#

GPU

This lecture was built using a machine with access to a GPU — although it will also run without one.

Google Colab has a free tier with GPUs that you can access as follows:

Click on the “play” icon top right

Select Colab

Set the runtime environment to include a GPU

In addition to what’s in Anaconda, this lecture will need the following library

!pip install jax

80.1. Overview#

This lecture describes an overlapping generations model with these features:

A competitive equilibrium with incomplete markets determines prices and quantities

Agents live many periods as in [Auerbach and Kotlikoff, 1987]

Agents receive idiosyncratic labor productivity shocks that cannot be fully insured as in [Aiyagari, 1994]

Government fiscal policy instruments include tax rates, debt, and transfers as in chapter 2 of [Auerbach and Kotlikoff, 1987] and Transitions in an Overlapping Generations Model

Among other equilibrium objects, a competitive equilibrium determines a sequence of cross-section densities of heterogeneous agents’ consumptions, labor incomes, and savings

We use the model to study:

How fiscal policies affect different generations

How market incompleteness promotes precautionary savings

How life-cycle savings and buffer-stock savings motives interact

How fiscal policies redistribute resources across and within generations

As prerequisites for this lecture, we recommend two quantecon lectures:

as well as the optional reading The Aiyagari Model

As usual, let’s start by importing some Python modules

from collections import namedtuple

import numpy as np

import matplotlib.pyplot as plt

import jax.numpy as jnp

import jax.scipy as jsp

import jax

80.2. Environment#

We start by introducing the economic environment we are operating in.

80.2.1. Demographics and time#

We work in discrete time indexed by \(t = 0, 1, 2, ...\).

Each agent lives for \(J = 50\) periods and faces no mortality risk.

We index age by \(j = 0, 1, ..., 49\), and the population size remains fixed at \(1/J\).

80.2.2. Individuals’ state variables#

Each agent \(i\) of age \(j\) at time \(t\) is characterized by two state variables: asset holdings \(a_{i,j,t}\) and idiosyncratic labor productivity \(\gamma_{i,j,t}\).

The idiosyncratic labor productivity process follows a two-state Markov chain that takes values \(\gamma_l\) and \(\gamma_h\) with transition matrix \(\Pi\).

Newborn agents begin with an initial distribution \(\pi = [0.5, 0.5]\) over these productivity states.

80.2.3. Labor supply#

An agent with productivity \(\gamma_{i,j,t}\) supplies \(l(j)\gamma_{i,j,t}\) efficiency units of labor.

\(l(j)\) is a deterministic age-specific labor efficiency units profile.

An agent’s effective labor supply depends on a life-cycle efficiency profile and an idiosyncratic stochastic process.

80.2.4. Initial conditions#

Newborns start with zero assets \(a_{i,0,t} = 0\).

Initial idiosyncratic productivities are drawn from distribution \(\pi\).

Agents leave no bequests and have terminal value function \(V_J(a) = 0\).

80.3. Production#

A representative firm operates a constant returns to scale Cobb-Douglas production:

where:

\(K_t\) is aggregate capital

\(L_t\) is aggregate efficiency units of labor

\(Z_t\) is total factor productivity

\(\alpha\) is the capital share

80.4. Government#

The government follows a fiscal policy that includes debt, taxes, transfers, and government spending.

The government issues one-period debt \(D_t\) to finance its operations and collects revenues through a flat-rate tax \(\tau_t\) on both labor and capital income.

The government also implements age-specific lump-sum taxes or transfers \(\delta_{j,t}\) that can redistribute resources across different age groups.

Additionally, it makes government purchases \(G_t\) for public goods and services.

The government budget constraint at time \(t\) is

where total tax revenues \(T_t\) satisfy

80.5. Activities in factor markets#

At each time \(t \geq 0\), agents supply labor and capital.

80.5.1. Age-specific labor supplies#

Agents of age \(j \in \{0,1,...,J-1\}\) supply labor according to:

Their deterministic age-efficiency profile \(l(j)\)

Their current idiosyncratic productivity shock \(\gamma_{i,j,t}\)

Each agent supplies \(l(j)\gamma_{i,j,t}\) effective units of labor and earns a competitive wage \(w_t\) per effective unit, subject to a flat tax rate \(\tau_t\) on labor earnings.

80.5.2. Asset market participation#

Summarizing activities in the asset market, all agents, regardless of age \(j \in \{0,1,...,J-1\}\), can:

Hold assets \(a_{i,j,t}\) (subject to borrowing constraints)

Earn a risk-free one-period return \(r_t\) on savings

Pay capital income taxes at flat rate \(\tau_t\)

Receive or pay age-specific transfers \(\delta_{j,t}\)

80.5.3. Key features#

Lifecycle patterns shape economic behavior across ages:

Labor productivity varies systematically with age according to the profile \(l(j)\), while asset holdings typically follow a lifecycle pattern of accumulation during working years and decumulation during retirement.

Age-specific fiscal transfers \(\delta_{j,t}\) redistribute resources across generations.

Within-cohort heterogeneity creates dispersion among agents of the same age:

Agents of the same age differ in their asset holdings \(a_{i,j,t}\) due to different histories of idiosyncratic productivity shocks, their current productivities \(\gamma_{i,j,t}\), and consequently their labor incomes and financial wealth.

Cross-cohort interactions determine equilibrium outcomes through market aggregation:

All cohorts participate together in factor markets, with asset supplies from all cohorts determining aggregate capital and effective labor supplies from all cohorts determining aggregate labor.

Equilibrium prices reflect both lifecycle and redistributive forces.

80.6. Representative firm’s problem#

A representative firm chooses capital and effective labor to maximize profits

First-order necessary conditions imply that

and

80.7. Households’ problems#

A household’s value function satisfies a Bellman equation

where maximization is subject to

and a terminal condition \(V_{J,t}(a, \gamma) = 0\)

80.8. Population dynamics#

The joint probability density function \(\mu_{j,t}(a,\gamma)\) of asset holdings and idiosyncratic labor productivity evolves according to

For newborns \((j=0)\):

For other cohorts:

\[ \mu_{j+1,t+1}(a',\gamma') = \int {\bf 1}_{\sigma_{j,t}(a,\gamma)=a'}\Pi(\gamma,\gamma')\mu_{j,t}(a,\gamma)d(a,\gamma) \]

where \(\sigma_{j,t}(a,\gamma)\) is the optimal saving policy function.

80.9. Equilibrium#

An equilibrium consists of:

Value functions \(V_{j,t}\)

Policy functions \(\sigma_{j,t}\)

Joint probability distributions \(\mu_{j,t}\)

Prices \(r_t, w_t\)

Government policies \(\tau_t, D_t, \delta_{j,t}, G_t\)

that satisfy the following conditions

Given prices and government policies, value and policy functions solve households’ problems

Given prices, the representative firm maximizes profits

Government budget constraints are satisfied

Markets clear:

Asset market: \(K_t = \sum_j \int a \mu_{j,t}(a,\gamma)d(a,\gamma) - D_t\)

Labor market: \(L_t = \sum_j \int l(j)\gamma \mu_{j,t}(a,\gamma)d(a,\gamma)\)

Relative to the model presented in Transitions in an Overlapping Generations Model, the present model adds

Heterogeneity within generations due to productivity shocks

A precautionary savings motive

More re-distributional effects

More complicated transition dynamics

80.10. Implementation#

Using tools in Discrete State Dynamic Programming, we solve our model by combining value function iteration with equilibrium price determination.

A sensible approach is to nest a discrete DP solver inside an outer loop that searches for market-clearing prices.

For a candidate sequence of prices interest rates \(r_t\) and wages \(w_t\), we can solve individual households’ dynamic programming problems using either value function iteration or policy iteration to obtain optimal policy functions.

We then deduce associated stationary joint probability distributions of asset holdings and idiosyncratic labor efficiency units for each age cohort.

This will give us an aggregate capital supply (from household savings) and a labor supply (from the age-efficiency profile and productivity shocks).

We can then compare these with capital and labor demand from firms, compute deviations between factor market supplies and demands, then update price guesses until we find market-clearing prices.

To construct transition dynamics, we can compute sequences of time-varying prices by using backward induction to compute value and policy functions, and forward iteration for the distributions of agents across states:

Outer loop (market clearing)

Guess initial prices (\(r_t, w_t\))

Iterate until asset and labor markets clear

Use firms’ first-order necessary conditions to update prices

Inner loop (individual dynamic programming)

For each age cohort:

Discretize asset and productivity state space

Use value function iteration or policy iteration

Solve for optimal savings policies

Compute stationary distributions

Aggregation

Sum across individual states within each cohort

Sum across cohorts both

Aggregate capital supply, and

Aggregate effective labor supply

Take into account population weights \(1/J\)

Transition dynamics

Backward induction:

Start from final steady state

Solve sequence of value functions

Forward iteration:

Start from initial distribution

Track cohort distributions over time

Market clearing in each period:

Solve for price sequences

Update until all markets clear in all periods

We start coding by defining helper functions that describe preferences, firms, and government budget constraints.

ϕ, k_bar = 0., 0.

@jax.jit

def V_bar(a):

"Terminal value function depending on the asset holding."

return - ϕ * (a - k_bar) ** 2

ν = 0.5

@jax.jit

def u(c):

"Utility from consumption."

return c ** (1 - ν) / (1 - ν)

l1, l2, l3 = 0.5, 0.05, -0.0008

@jax.jit

def l(j):

"Age-specific wage profile."

return l1 + l2 * j + l3 * j ** 2

Let’s define a Firm namedtuple that contains parameters governing the production technology.

Firm = namedtuple("Firm", ("α", "Z"))

def create_firm(α=0.3, Z=1):

return Firm(α=α, Z=Z)

firm = create_firm()

The following helper functions link aggregates (\(K, L\)) and prices (\(w, r\)) that emerge from the representative firm’s first-order necessary conditions.

@jax.jit

def KL_to_r(K, L, firm):

α, Z = firm

return Z * α * (K / L) ** (α - 1)

@jax.jit

def KL_to_w(K, L, firm):

α, Z = firm

return Z * (1 - α) * (K / L) ** α

We use a function find_τ to find flat tax rates that balance the government budget constraint given other policy variables that include debt levels, government spending, and transfers.

@jax.jit

def find_τ(policy, price, aggs):

D, D_next, G, δ = policy

r, w = price

K, L = aggs

num = r * D + G - D_next + D - δ.sum(axis=-1)

denom = w * L + r * (D + K)

return num / denom

We use a namedtuple Household to store parameters that characterize households’ problems.

Household = namedtuple("Household", ("j_grid", "a_grid", "γ_grid",

"Π", "β", "init_μ", "VJ"))

def create_household(

a_min=0., a_max=10, a_size=200,

Π=[[0.9, 0.1], [0.1, 0.9]],

γ_grid=[0.5, 1.5],

β=0.96, J=50

):

j_grid = jnp.arange(J)

a_grid = jnp.linspace(a_min, a_max, a_size)

γ_grid, Π = map(jnp.array, (γ_grid, Π))

γ_size = len(γ_grid)

# Population distribution of new borns

init_μ = jnp.zeros((a_size * γ_size))

# Newborns are endowed with zero asset

# and equal probability of γ

init_μ = init_μ.at[:γ_size].set(1 / γ_size)

# Terminal value V_bar(a)

VJ = jnp.empty(a_size * γ_size)

for a_i in range(a_size):

a = a_grid[a_i]

VJ = VJ.at[a_i*γ_size:(a_i+1)*γ_size].set(V_bar(a))

return Household(j_grid=j_grid, a_grid=a_grid, γ_grid=γ_grid,

Π=Π, β=β, init_μ=init_μ, VJ=VJ)

hh = create_household()

We apply discrete state dynamic programming tools.

Initial steps involve preparing rewards and transition matrices \(R\) and \(Q\) for our discretized Bellman equations.

@jax.jit

def populate_Q(household):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

num_state = a_grid.size * γ_grid.size

num_action = a_grid.size

Q = jsp.linalg.block_diag(*[Π]*a_grid.size)

Q = Q.reshape((num_state, num_action, γ_grid.size))

Q = jnp.tile(Q, a_grid.size).T

return Q

@jax.jit

def populate_R(j, r, w, τ, δ, household):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

num_state = a_grid.size * γ_grid.size

num_action = a_grid.size

a = jnp.reshape(a_grid, (a_grid.size, 1, 1))

γ = jnp.reshape(γ_grid, (1, γ_grid.size, 1))

ap = jnp.reshape(a_grid, (1, 1, a_grid.size))

c = (1 + r*(1-τ)) * a + (1-τ) * w * l(j) * γ - δ[j] - ap

return jnp.reshape(jnp.where(c > 0, u(c), -jnp.inf),

(num_state, num_action))

80.11. Computing a steady state#

We first compute a steady state.

Given guesses of prices and taxes, we can use backwards induction to solve for value functions and optimal consumption and saving policies at all ages.

The function backwards_opt solves for optimal values by applying the discretized bellman operator backwards.

We use jax.lax.scan to facilitate sequential and recurrent computations efficiently.

@jax.jit

def backwards_opt(prices, taxes, household, Q):

r, w = prices

τ, δ = taxes

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J = j_grid.size

num_state = a_grid.size * γ_grid.size

num_action = a_grid.size

def bellman_operator_j(V_next, j):

"Solve household optimization problem at age j given Vj+1"

Rj = populate_R(j, r, w, τ, δ, household)

vals = Rj + β * Q.dot(V_next)

σ_j = jnp.argmax(vals, axis=1)

V_j = vals[jnp.arange(num_state), σ_j]

return V_j, (V_j, σ_j)

js = jnp.arange(J-1, -1, -1)

init_V = VJ

# Iterate from age J to 1

_, outputs = jax.lax.scan(bellman_operator_j, init_V, js)

V, σ = outputs

V = V[::-1]

σ = σ[::-1]

return V, σ

r, w = 0.05, 1

τ, δ = 0.15, np.zeros(hh.j_grid.size)

Q = populate_Q(hh)

V, σ = backwards_opt([r, w], [τ, δ], hh, Q)

Let’s time the computation with block_until_ready() to ensure that all JAX operations are complete

%time backwards_opt([r, w], [τ, δ], hh, Q)[0].block_until_ready();

CPU times: user 1.08 ms, sys: 614 μs, total: 1.69 ms

Wall time: 50.7 ms

From the optimal consumption and saving choices by each cohort, we can compute a joint probability distribution of asset levels and idiosyncratic productivity levels in a steady state.

@jax.jit

def popu_dist(σ, household, Q):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J = hh.j_grid.size

num_state = hh.a_grid.size * hh.γ_grid.size

def update_popu_j(μ_j, j):

"Update population distribution from age j to j+1"

Qσ = Q[jnp.arange(num_state), σ[j]]

μ_next = μ_j @ Qσ

return μ_next, μ_next

js = jnp.arange(J-1)

# iterate from age 1 to J

_, μ = jax.lax.scan(update_popu_j, init_μ, js)

μ = jnp.concatenate([init_μ[jnp.newaxis], μ], axis=0)

return μ

μ = popu_dist(σ, hh, Q)

Let’s time the computation

%time popu_dist(σ, hh, Q)[0].block_until_ready();

CPU times: user 39.3 ms, sys: 1.01 ms, total: 40.3 ms

Wall time: 53 ms

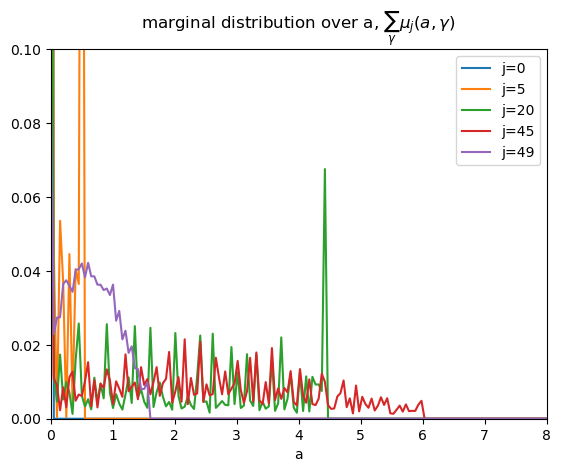

Below we plot the marginal distribution of savings for each age group.

for j in [0, 5, 20, 45, 49]:

plt.plot(hh.a_grid, jnp.sum(μ[j].reshape((hh.a_grid.size, hh.γ_grid.size)), axis=1), label=f'j={j}')

plt.legend()

plt.xlabel('a')

plt.title(r'marginal distribution over a, $\sum_\gamma \mu_j(a, \gamma)$')

plt.xlim([0, 8])

plt.ylim([0, 0.1])

plt.show()

These marginal distributions confirm that new agents enter the economy with no asset holdings.

the blue \(j=0\) distribution has mass only at \(a=0\).

As agents age, at first they gradually accumulate assets.

the orange \(j=5\) distribution puts positive mass on positive but low asset levels

the green \(j=20\) distribution puts positive mass on a much wider range of asset levels.

the red \(j=45\) distribution is even wider

At a later age, they gradually deplete their asset holdings.

the purple \(j=49\) distribution illustrates this

At the end of life, they will have drawn down all of their assets.

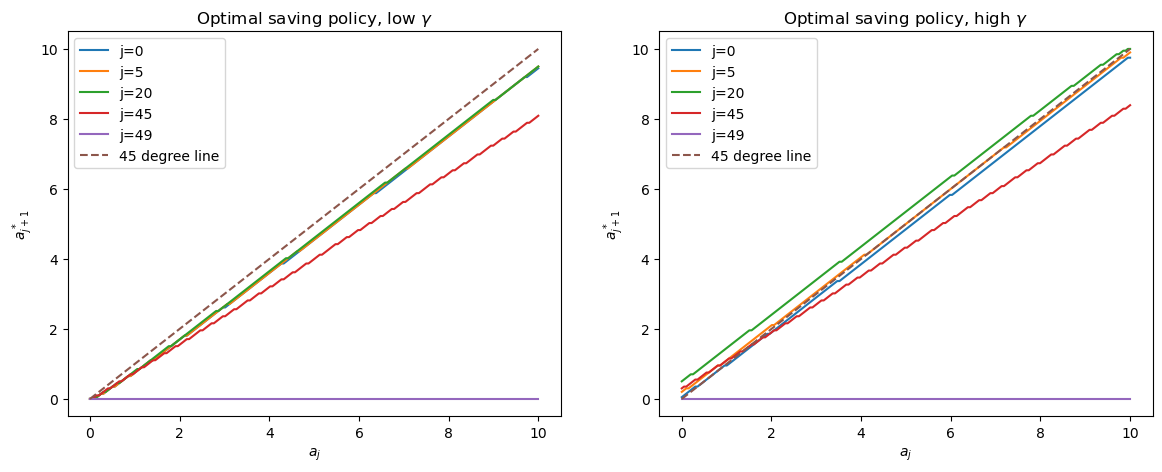

Let’s now look at age-specific optimal saving policies that generate the preceding marginal distributions of assets at different ages.

We’ll plot some saving functions with the following Python code.

σ_reshaped = σ.reshape(hh.j_grid.size, hh.a_grid.size, hh.γ_grid.size)

j_labels = [f'j={j}' for j in [0, 5, 20, 45, 49]]

fig, axs = plt.subplots(1, 2, figsize=(14, 5))

axs[0].plot(hh.a_grid, hh.a_grid[σ_reshaped[[0, 5, 20, 45, 49], :, 0].T])

axs[0].plot(hh.a_grid, hh.a_grid, '--')

axs[0].set_xlabel("$a_{j}$")

axs[0].set_ylabel("$a^*_{j+1}$")

axs[0].legend(j_labels+['45 degree line'])

axs[0].set_title(r"Optimal saving policy, low $\gamma$")

axs[1].plot(hh.a_grid, hh.a_grid[σ_reshaped[[0, 5, 20, 45, 49], :, 1].T])

axs[1].plot(hh.a_grid, hh.a_grid, '--')

axs[1].set_xlabel("$a_{j}$")

axs[1].set_ylabel("$a^*_{j+1}$")

axs[1].legend(j_labels+['45 degree line'])

axs[1].set_title(r"Optimal saving policy, high $\gamma$")

plt.show()

From an implied stationary population distribution, we can compute the aggregate labor supply \(L\) and private savings \(A\).

@jax.jit

def compute_aggregates(μ, household):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J, a_size, γ_size = j_grid.size, a_grid.size, γ_grid.size

μ = μ.reshape((J, hh.a_grid.size, hh.γ_grid.size))

# Compute private savings

a = a_grid.reshape((1, a_size, 1))

A = (a * μ).sum() / J

γ = γ_grid.reshape((1, 1, γ_size))

lj = l(j_grid).reshape((J, 1, 1))

L = (lj * γ * μ).sum() / J

return A, L

A, L = compute_aggregates(μ, hh)

A, L

(Array(1.8594263, dtype=float32), Array(1.0781993, dtype=float32))

The capital stock in this economy equals \(A-D\).

D = 0

K = A - D

The firm’s optimality conditions imply interest rate \(r\) and wage rate \(w\).

KL_to_r(K, L, firm), KL_to_w(K, L, firm)

(Array(0.20485441, dtype=float32), Array(0.8243317, dtype=float32))

The implied prices \((r,w)\) differ from our guesses, so we must update our guesses and iterate until we find a fixed point.

This is our outer loop.

@jax.jit

def find_ss(household, firm, pol_target, Q, tol=1e-6, verbose=False):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J = j_grid.size

num_state = a_grid.size * γ_grid.size

D, G, δ = pol_target

# Initial guesses of prices

r, w = 0.05, 1.

# Initial guess of τ

τ = 0.15

def cond_fn(state):

"The convergence criteria."

V, σ, μ, K, L, r, w, τ, D, G, δ, r_old, w_old = state

error = (r - r_old) ** 2 + (w - w_old) ** 2

return error > tol

def body_fn(state):

"The main body of iteration."

V, σ, μ, K, L, r, w, τ, D, G, δ, r_old, w_old = state

r_old, w_old, τ_old = r, w, τ

# Household optimal decisions and values

V, σ = backwards_opt([r, w], [τ, δ], hh, Q)

# Compute the stationary distribution

μ = popu_dist(σ, hh, Q)

# Compute aggregates

A, L = compute_aggregates(μ, hh)

K = A - D

# Update prices

r, w = KL_to_r(K, L, firm), KL_to_w(K, L, firm)

# Find τ

D_next = D

τ = find_τ([D, D_next, G, δ],

[r, w],

[K, L])

r = (r + r_old) / 2

w = (w + w_old) / 2

return V, σ, μ, K, L, r, w, τ, D, G, δ, r_old, w_old

# Initial state

V = jnp.empty((J, num_state), dtype=float)

σ = jnp.empty((J, num_state), dtype=int)

μ = jnp.empty((J, num_state), dtype=float)

K, L = 1., 1.

initial_state = (V, σ, μ, K, L, r, w, τ, D, G, δ, r-1, w-1)

V, σ, μ, K, L, r, w, τ, D, G, δ, _, _ = jax.lax.while_loop(

cond_fn, body_fn, initial_state)

return V, σ, μ, K, L, r, w, τ, D, G, δ

ss1 = find_ss(hh, firm, [0, 0.1, np.zeros(hh.j_grid.size)], Q, verbose=True)

Let’s time the computation

%time find_ss(hh, firm, [0, 0.1, np.zeros(hh.j_grid.size)], Q)[0].block_until_ready();

CPU times: user 656 ms, sys: 15.3 ms, total: 672 ms

Wall time: 736 ms

hh_out_ss1 = ss1[:3]

quant_ss1 = ss1[3:5]

price_ss1 = ss1[5:7]

policy_ss1 = ss1[7:11]

# V, σ, μ

V_ss1, σ_ss1, μ_ss1 = hh_out_ss1

# K, L

K_ss1, L_ss1 = quant_ss1

K_ss1, L_ss1

(Array(6.6221957, dtype=float32), Array(1.0781994, dtype=float32))

# r, w

r_ss1, w_ss1 = price_ss1

r_ss1, w_ss1

(Array(0.08430456, dtype=float32), Array(1.2056923, dtype=float32))

# τ, D, G, δ

τ_ss1, D_ss1, G_ss1, δ_ss1 = policy_ss1

τ_ss1, D_ss1, G_ss1, δ_ss1

(Array(0.05380344, dtype=float32),

Array(0, dtype=int32, weak_type=True),

Array(0.1, dtype=float32, weak_type=True),

Array([0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0.,

0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0.,

0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0., 0.], dtype=float32))

80.12. Transition dynamics#

We compute transition dynamics using a function path_iteration.

In an outer loop, we iterate over guesses of prices and taxes.

In an inner loop, we compute the optimal consumption and saving choices by each cohort \(j\) in each time \(t\), then find the implied evolution of the joint distribution of assets and productivities.

We then update our guesses of prices and taxes given the aggregate labor supply and capital stock in the economy.

We use solve_backwards to solve for optimal saving choices given price and tax sequences and simulate_forward to compute the evolution of the joint distributions.

We require two steady states as inputs: the initial steady state to provide the initial condition for simulate_forward, and the final steady state to provide continuation values for solve_backwards.

@jax.jit

def bellman_operator(prices, taxes, V_next, household, Q):

r, w = prices

τ, δ = taxes

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J = j_grid.size

num_state = a_grid.size * γ_grid.size

num_action = a_grid.size

def bellman_operator_j(j):

Rj = populate_R(j, r, w, τ, δ, household)

vals = Rj + β * Q.dot(V_next[j+1])

σ_j = jnp.argmax(vals, axis=1)

V_j = vals[jnp.arange(num_state), σ_j]

return V_j, σ_j

V, σ = jax.vmap(bellman_operator_j, (0,))(jnp.arange(J-1))

# The last life stage

j = J-1

Rj = populate_R(j, r, w, τ, δ, household)

vals = Rj + β * Q.dot(VJ)

σ = jnp.concatenate([σ, jnp.argmax(vals, axis=1)[jnp.newaxis]])

V = jnp.concatenate([V, vals[jnp.arange(num_state), σ[j]][jnp.newaxis]])

return V, σ

@jax.jit

def solve_backwards(V_ss2, σ_ss2, household, firm, price_seq, pol_seq, Q):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J = j_grid.size

num_state = a_grid.size * γ_grid.size

τ_seq, D_seq, G_seq, δ_seq = pol_seq

r_seq, w_seq = price_seq

T = r_seq.size

def solve_backwards_t(V_next, t):

prices = (r_seq[t], w_seq[t])

taxes = (τ_seq[t], δ_seq[t])

V, σ = bellman_operator(prices, taxes, V_next, household, Q)

return V, (V,σ)

ts = jnp.arange(T-2, -1, -1)

init_V = V_ss2

_, outputs = jax.lax.scan(solve_backwards_t, init_V, ts)

V_seq, σ_seq = outputs

V_seq = V_seq[::-1]

σ_seq = σ_seq[::-1]

V_seq = jnp.concatenate([V_seq, V_ss2[jnp.newaxis]])

σ_seq = jnp.concatenate([σ_seq, σ_ss2[jnp.newaxis]])

return V_seq, σ_seq

@jax.jit

def population_evolution(σt, μt, household, Q):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J = hh.j_grid.size

num_state = hh.a_grid.size * hh.γ_grid.size

def population_evolution_j(j):

Qσ = Q[jnp.arange(num_state), σt[j]]

μ_next = μt[j] @ Qσ

return μ_next

μ_next = jax.vmap(population_evolution_j, (0,))(jnp.arange(J-1))

μ_next = jnp.concatenate([init_μ[jnp.newaxis], μ_next])

return μ_next

@jax.jit

def simulate_forwards(σ_seq, D_seq, μ_ss1, K_ss1, L_ss1, household, Q):

j_grid, a_grid, γ_grid, Π, β, init_μ, VJ = household

J, num_state = μ_ss1.shape

T = σ_seq.shape[0]

def simulate_forwards_t(μ, t):

μ_next = population_evolution(σ_seq[t], μ, household, Q)

A, L = compute_aggregates(μ_next, household)

K = A - D_seq[t+1]

return μ_next, (μ_next, K, L)

ts = jnp.arange(T-1)

init_μ = μ_ss1

_, outputs = jax.lax.scan(simulate_forwards_t, init_μ, ts)

μ_seq, K_seq, L_seq = outputs

μ_seq = jnp.concatenate([μ_ss1[jnp.newaxis], μ_seq])

K_seq = jnp.concatenate([K_ss1[jnp.newaxis], K_seq])

L_seq = jnp.concatenate([L_ss1[jnp.newaxis], L_seq])

return μ_seq, K_seq, L_seq

The following algorithm describes the path iteration procedure:

Algorithm 80.1 (AK-Aiyagari transition path algorithm)

Inputs Given initial steady state \(ss_1\), final steady state \(ss_2\), time horizon \(T\), and policy sequences \((D, G, \delta)\)

Output Compute equilibrium transition paths for value functions \(V\), policy functions \(\sigma\), distributions \(\mu\), and prices \((r, w, \tau)\)

Initialize from steady states:

\((V_1, \sigma_1, \mu_1) \leftarrow ss_1\) (Initial steady state)

\((V_2, \sigma_2, \mu_2) \leftarrow ss_2\) (Final steady state)

\((r, w, \tau) \leftarrow initialize\_prices(T)\) (Linear interpolation)

\(error \leftarrow \infty\), \(i \leftarrow 0\)

While \(error > \varepsilon\) or \(i \leq max\_iter\):

\(i \leftarrow i + 1\)

\((r_{\text{old}}, w_{\text{old}}, \tau_{\text{old}}) \leftarrow (r, w, \tau)\)

Backward induction: For \(t \in [T, 1]\):

For \(j \in [0, J-1]\) (age groups):

\(V[t,j] \leftarrow \max_{a'} \{u(c) + \beta\mathbb{E}[V[t+1,j+1]]\}\)

\(\sigma[t,j] \leftarrow \arg\max_{a'} \{u(c) + \beta\mathbb{E}[V[t+1,j+1]]\}\)

Forward simulation: For \(t \in [1, T]\):

\(\mu[t] \leftarrow \Gamma(\sigma[t], \mu[t-1])\) (Distribution evolution)

\(K[t] \leftarrow \int a \, d\mu[t] - D[t]\) (Aggregate capital)

\(L[t] \leftarrow \int l(j)\gamma \, d\mu[t]\) (Aggregate labor)

\(r[t] \leftarrow \alpha Z(K[t]/L[t])^{\alpha-1}\) (Interest rate)

\(w[t] \leftarrow (1-\alpha)Z(K[t]/L[t])^{\alpha}\) (Wage rate)

\(\tau[t] \leftarrow solve\_budget(r[t],w[t],K[t],L[t],D[t],G[t])\)

Compute convergence metric:

\(error \leftarrow \|r - r_{\text{old}}\| + \|w - w_{\text{old}}\| + \|\tau - \tau_{\text{old}}\|\)

Update prices with dampening:

\(r \leftarrow \lambda r + (1-\lambda)r_{\text{old}}\)

\(w \leftarrow \lambda w + (1-\lambda)w_{\text{old}}\)

\(\tau \leftarrow \lambda \tau + (1-\lambda)\tau_{\text{old}}\)

Return \((V, \sigma, \mu, r, w, \tau)\)

def path_iteration(ss1, ss2, pol_target, household, firm, Q, tol=1e-4, verbose=False):

# Starting point: initial steady state

V_ss1, σ_ss1, μ_ss1 = ss1[:3]

K_ss1, L_ss1 = ss1[3:5]

r_ss1, w_ss1 = ss1[5:7]

τ_ss1, D_ss1, G_ss1, δ_ss1 = ss1[7:11]

# Ending point: converging new steady state

V_ss2, σ_ss2, μ_ss2 = ss2[:3]

K_ss2, L_ss2 = ss2[3:5]

r_ss2, w_ss2 = ss2[5:7]

τ_ss2, D_ss2, G_ss2, δ_ss2 = ss2[7:11]

# The given policies: D, G, δ

D_seq, G_seq, δ_seq = pol_target

T = G_seq.shape[0]

# Initial guesses of prices

r_seq = jnp.linspace(0, 1, T) * (r_ss2 - r_ss1) + r_ss1

w_seq = jnp.linspace(0, 1, T) * (w_ss2 - w_ss1) + w_ss1

# Initial guess of policy

τ_seq = jnp.linspace(0, 1, T) * (τ_ss2 - τ_ss1) + τ_ss1

error = 1

num_iter = 0

if verbose:

fig, axs = plt.subplots(1, 3, figsize=(14, 3))

axs[0].plot(jnp.arange(T), r_seq)

axs[1].plot(jnp.arange(T), w_seq)

axs[2].plot(jnp.arange(T), τ_seq, label=f'iter {num_iter}')

while error > tol:

# Repeat until finding the fixed point

r_old, w_old, τ_old = r_seq, w_seq, τ_seq

pol_seq = (τ_seq, D_seq, G_seq, δ_seq)

price_seq = (r_seq, w_seq)

# Solve optimal policies backwards

V_seq, σ_seq = solve_backwards(

V_ss2, σ_ss2, hh, firm, price_seq, pol_seq, Q)

# Compute population evolution forwards

μ_seq, K_seq, L_seq = simulate_forwards(

σ_seq, D_seq, μ_ss1, K_ss1, L_ss1, household, Q)

# Update prices by aggregate capital and labor supply

r_seq = KL_to_r(K_seq, L_seq, firm)

w_seq = KL_to_w(K_seq, L_seq, firm)

# Find taxes that balance the government budget constraint

τ_seq = find_τ([D_seq[:-1], D_seq[1:], G_seq, δ_seq],

[r_seq, w_seq],

[K_seq, L_seq])

# Distance between new and old guesses

error = jnp.sum((r_old - r_seq) ** 2) + \

jnp.sum((w_old - w_seq) ** 2) + \

jnp.sum((τ_old - τ_seq) ** 2)

num_iter += 1

if verbose:

print(f"Iteration {num_iter:3d}: error = {error:.6e}")

axs[0].plot(jnp.arange(T), r_seq)

axs[1].plot(jnp.arange(T), w_seq)

axs[2].plot(jnp.arange(T), τ_seq, label=f'iter {num_iter}')

r_seq = (r_seq + r_old) / 2

w_seq = (w_seq + w_old) / 2

τ_seq = (τ_seq + τ_old) / 2

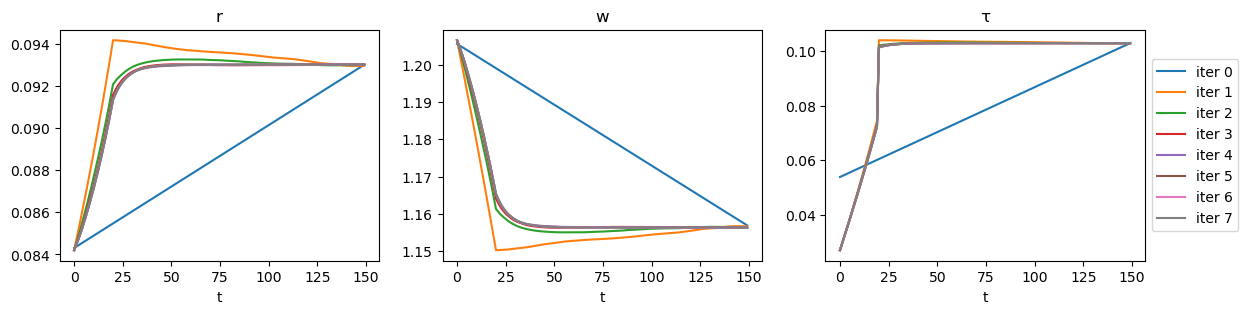

if verbose:

axs[0].set_xlabel('t')

axs[1].set_xlabel('t')

axs[2].set_xlabel('t')

axs[0].set_title('r')

axs[1].set_title('w')

axs[2].set_title('τ')

axs[2].legend(loc='center left', bbox_to_anchor=(1, 0.5))

return V_seq, σ_seq, μ_seq, K_seq, L_seq, r_seq, w_seq, \

τ_seq, D_seq, G_seq, δ_seq

We can now compute equilibrium transitions that are ignited by fiscal policy reforms.

80.13. Experiment 1: Immediate tax cut#

Assume that the government cuts the tax rate and immediately balances its budget by issuing debt.

At \(t=0\), the government unexpectedly announces an immediate tax cut.

From \(t=0\) to \(19\), the government issues debt, so debt \(D_{t+1}\) increases linearly for \(20\) periods.

The government sets a target for its new debt level \(D_{20} =D_0 + 1 = \bar{D} + 1\).

Government spending \(\bar{G}\) and transfers \(\bar{\delta}_j\) remain constant.

The government adjusts \(\tau_t\) to balance the budget along the transition.

We want to compute the equilibrium transition path.

Our first step is to prepare appropriate policy variable arrays D_seq, G_seq, δ_seq

We’ll compute a τ_seq that balances government budgets.

T = 150

D_seq = jnp.ones(T+1) * D_ss1

D_seq = D_seq.at[:21].set(D_ss1 + jnp.linspace(0, 1, 21))

D_seq = D_seq.at[21:].set(D_seq[20])

G_seq = jnp.ones(T) * G_ss1

δ_seq = jnp.repeat(δ_ss1, T).reshape((T, δ_ss1.size))

In order to iterate the path, we need to first find its destination, which is the new steady state under the new fiscal policy.

ss2 = find_ss(hh, firm, [D_seq[-1], G_seq[-1], δ_seq[-1]], Q)

We can use path_iteration to find equilibrium transition dynamics.

Setting the key argument verbose=True tells the function path_iteration to display convergence information.

paths = path_iteration(ss1, ss2, [D_seq, G_seq, δ_seq], hh, firm, Q, verbose=True)

Iteration 1: error = 2.075169e-01

Iteration 2: error = 3.733911e-02

Iteration 3: error = 7.672485e-03

Iteration 4: error = 1.819943e-03

Iteration 5: error = 4.734877e-04

Iteration 6: error = 1.216737e-04

Iteration 7: error = 2.955517e-05

Having successfully computed transition dynamics, let’s study them.

V_seq, σ_seq, μ_seq = paths[:3]

K_seq, L_seq = paths[3:5]

r_seq, w_seq = paths[5:7]

τ_seq, D_seq, G_seq, δ_seq = paths[7:11]

ap = hh.a_grid[σ_seq[0]]

j = jnp.reshape(hh.j_grid, (hh.j_grid.size, 1, 1))

lj = l(j)

a = jnp.reshape(hh.a_grid, (1, hh.a_grid.size, 1))

γ = jnp.reshape(hh.γ_grid, (1, 1, hh.γ_grid.size))

t = 0

ap = hh.a_grid[σ_seq[t]]

δ = δ_seq[t].reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_seq[t]*(1-τ_seq[t])) * a \

+ (1-τ_seq[t]) * w_seq[t] * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

c_mean0 = (c * μ_seq[t]).sum(axis=1)

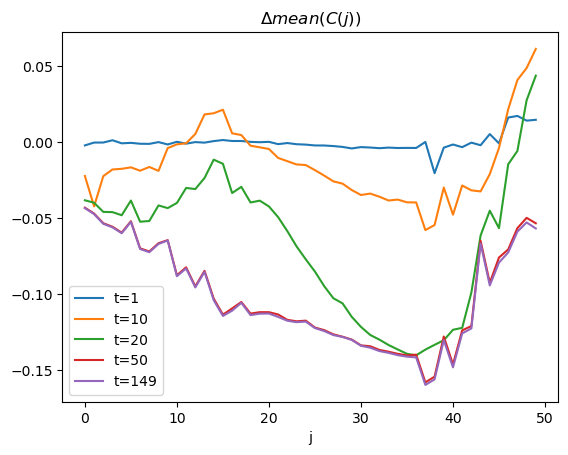

We care about how the policy change affects consumption across cohorts and across time.

We can study age-specific average consumption levels.

for t in [1, 10, 20, 50, 149]:

ap = hh.a_grid[σ_seq[t]]

δ = δ_seq[t].reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_seq[t]*(1-τ_seq[t])) * a + (1-τ_seq[t]) * w_seq[t] * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

c_mean = (c * μ_seq[t]).sum(axis=1)

plt.plot(range(hh.j_grid.size), c_mean-c_mean0, label=f't={t}')

plt.legend()

plt.xlabel(r'j')

plt.title(r'$\Delta mean(C(j))$')

plt.show()

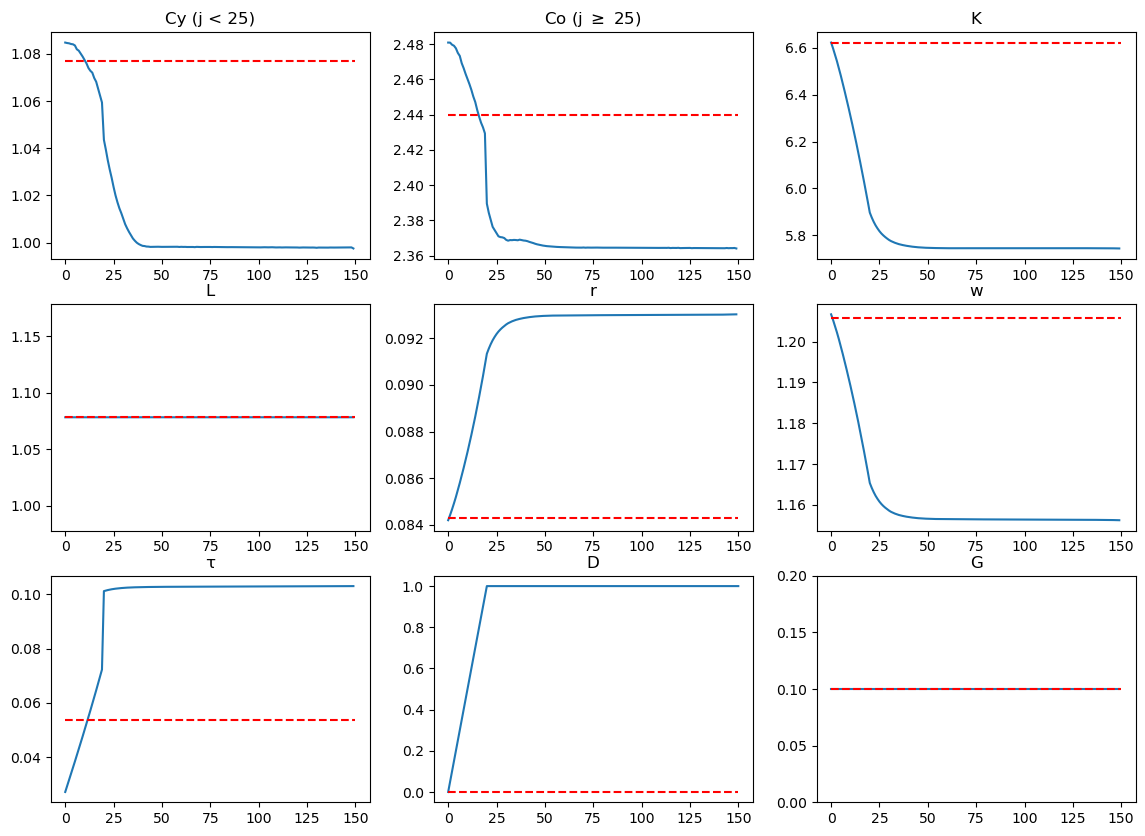

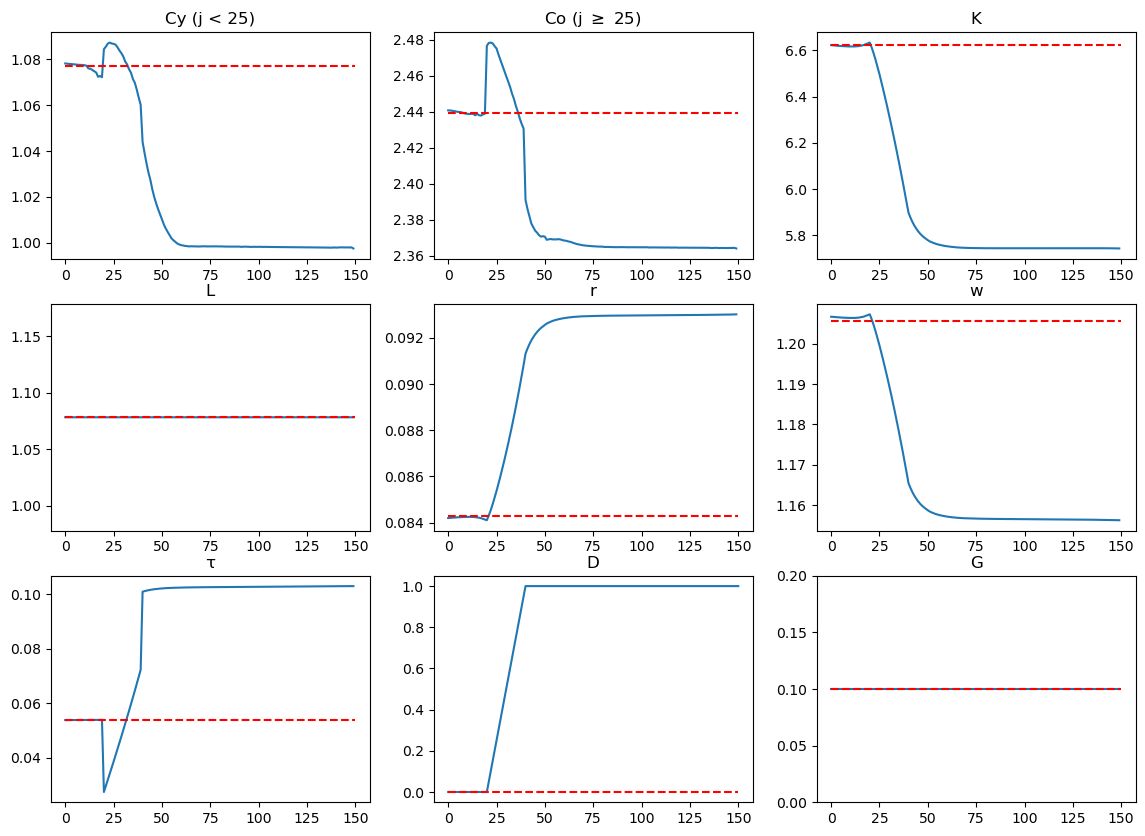

To summarize the transition, we can plot paths as we did in Transitions in an Overlapping Generations Model.

But unlike the setup in that two-period lived overlapping generations model, we no longer have representative old and young agents.

now we have 50 cohorts of different ages at each time

To proceed, we construct two age groups of equal size – young and old.

at age 25, someone moves from being young to becoming old

ap = hh.a_grid[σ_ss1]

J = hh.j_grid.size

δ = δ_ss1.reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_ss1*(1-τ_ss1)) * a + (1-τ_ss1) * w_ss1 * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

Cy_ss1 = (c[:J//2] * μ_ss1[:J//2]).sum() / (J // 2)

Co_ss1 = (c[J//2:] * μ_ss1[J//2:]).sum() / (J // 2)

T = σ_seq.shape[0]

J = σ_seq.shape[1]

Cy_seq = np.empty(T)

Co_seq = np.empty(T)

for t in range(T):

ap = hh.a_grid[σ_seq[t]]

δ = δ_seq[t].reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_seq[t]*(1-τ_seq[t])) * a + (1-τ_seq[t]) * w_seq[t] * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

Cy_seq[t] = (c[:J//2] * μ_seq[t, :J//2]).sum() / (J // 2)

Co_seq[t] = (c[J//2:] * μ_seq[t, J//2:]).sum() / (J // 2)

fig, axs = plt.subplots(3, 3, figsize=(14, 10))

# Cy (j=0-24)

axs[0, 0].plot(Cy_seq)

axs[0, 0].hlines(Cy_ss1, 0, T, color='r', linestyle='--')

axs[0, 0].set_title('Cy (j < 25)')

# Cy (j=25-49)

axs[0, 1].plot(Co_seq)

axs[0, 1].hlines(Co_ss1, 0, T, color='r', linestyle='--')

axs[0, 1].set_title(r'Co (j $\geq$ 25)')

names = ['K', 'L', 'r', 'w', 'τ', 'D', 'G']

for i in range(len(names)):

i_var = i + 3

i_axes = i + 2

row_i = i_axes // 3

col_i = i_axes % 3

axs[row_i, col_i].plot(paths[i_var])

axs[row_i, col_i].hlines(ss1[i_var], 0, T, color='r', linestyle='--')

axs[row_i, col_i].set_title(names[i])

# ylims

axs[1, 0].set_ylim([ss1[4]-0.1, ss1[4]+0.1])

axs[2, 2].set_ylim([ss1[9]-0.1, ss1[9]+0.1])

plt.show()

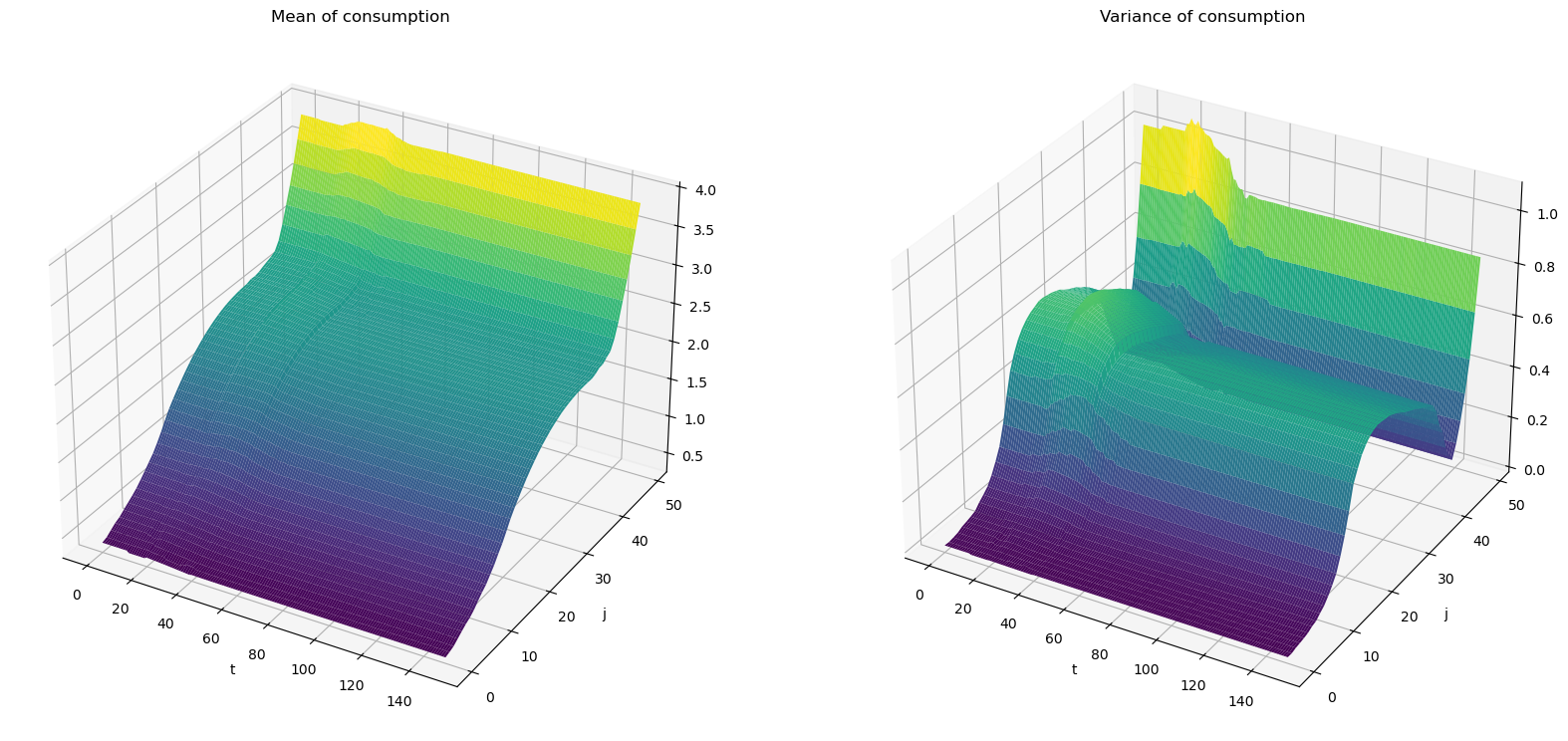

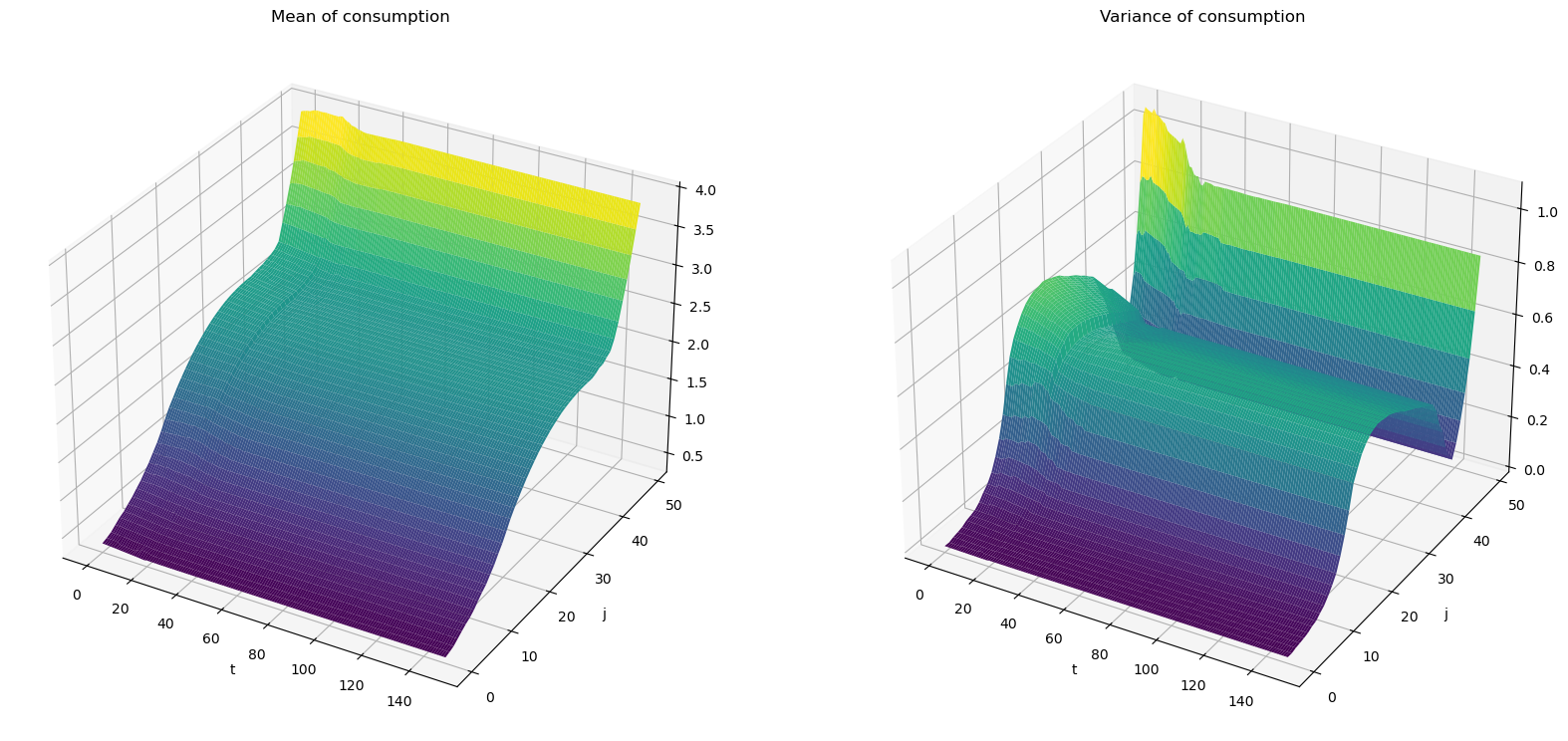

Now let’s compute the mean and variance of consumption conditional on age at each time \(t\).

Cmean_seq = np.empty((T, J))

Cvar_seq = np.empty((T, J))

for t in range(T):

ap = hh.a_grid[σ_seq[t]]

δ = δ_seq[t].reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_seq[t]*(1-τ_seq[t])) * a + (1-τ_seq[t]) * w_seq[t] * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

Cmean_seq[t] = (c * μ_seq[t]).sum(axis=1)

Cvar_seq[t] = ((c - Cmean_seq[t].reshape((J, 1))) ** 2 * μ_seq[t]).sum(axis=1)

J_seq, T_range = np.meshgrid(np.arange(J), np.arange(T))

fig = plt.figure(figsize=[20, 20])

# Plot the consumption mean over age and time

ax1 = fig.add_subplot(121, projection='3d')

ax1.plot_surface(T_range, J_seq, Cmean_seq, rstride=1, cstride=1,

cmap='viridis', edgecolor='none')

ax1.set_title(r"Mean of consumption")

ax1.set_xlabel(r"t")

ax1.set_ylabel(r"j")

# plot the consumption variance over age and time

ax2 = fig.add_subplot(122, projection='3d')

ax2.plot_surface(T_range, J_seq, Cvar_seq, rstride=1, cstride=1,

cmap='viridis', edgecolor='none')

ax2.set_title(r"Variance of consumption")

ax2.set_xlabel(r"t")

ax2.set_ylabel(r"j")

plt.show()

80.14. Experiment 2: Preannounced tax cut#

Now the government announces a permanent tax rate cut at time \(0\) but implements it only after 20 periods.

We will use the same key toolkit path_iteration.

We must specify D_seq appropriately.

T = 150

D_t = 20

D_seq = jnp.ones(T+1) * D_ss1

D_seq = D_seq.at[D_t:D_t+21].set(D_ss1 + jnp.linspace(0, 1, 21))

D_seq = D_seq.at[D_t+21:].set(D_seq[D_t+20])

G_seq = jnp.ones(T) * G_ss1

δ_seq = jnp.repeat(δ_ss1, T).reshape((T, δ_ss1.size))

ss2 = find_ss(hh, firm, [D_seq[-1], G_seq[-1], δ_seq[-1]], Q)

paths = path_iteration(ss1, ss2, [D_seq, G_seq, δ_seq],

hh, firm, Q, verbose=True)

Iteration 1: error = 1.300627e-01

Iteration 2: error = 2.349870e-02

Iteration 3: error = 4.931191e-03

Iteration 4: error = 1.196040e-03

Iteration 5: error = 3.122933e-04

Iteration 6: error = 7.865898e-05

V_seq, σ_seq, μ_seq = paths[:3]

K_seq, L_seq = paths[3:5]

r_seq, w_seq = paths[5:7]

τ_seq, D_seq, G_seq, δ_seq = paths[7:11]

T = σ_seq.shape[0]

J = σ_seq.shape[1]

Cy_seq = np.empty(T)

Co_seq = np.empty(T)

for t in range(T):

ap = hh.a_grid[σ_seq[t]]

δ = δ_seq[t].reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_seq[t]*(1-τ_seq[t])) * a + (1-τ_seq[t]) * w_seq[t] * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

Cy_seq[t] = (c[:J//2] * μ_seq[t, :J//2]).sum() / (J // 2)

Co_seq[t] = (c[J//2:] * μ_seq[t, J//2:]).sum() / (J // 2)

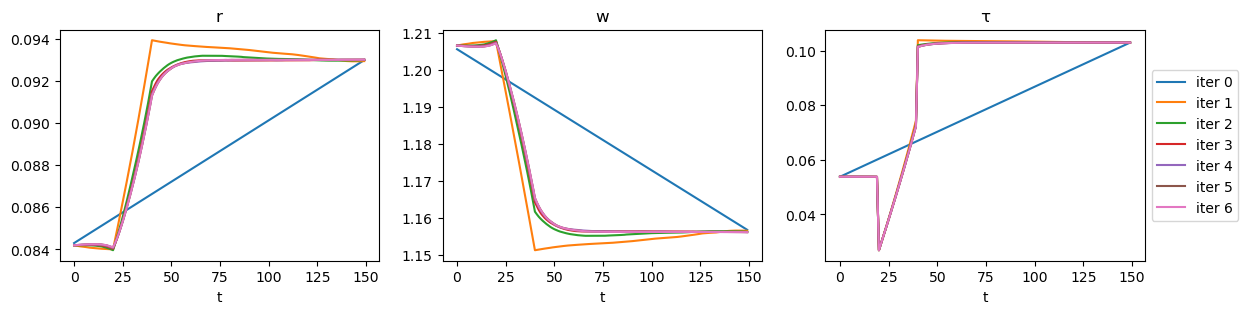

Below we plot the transition paths of the economy.

fig, axs = plt.subplots(3, 3, figsize=(14, 10))

# Cy (j=0-24)

axs[0, 0].plot(Cy_seq)

axs[0, 0].hlines(Cy_ss1, 0, T, color='r', linestyle='--')

axs[0, 0].set_title('Cy (j < 25)')

# Cy (j=25-49)

axs[0, 1].plot(Co_seq)

axs[0, 1].hlines(Co_ss1, 0, T, color='r', linestyle='--')

axs[0, 1].set_title(r'Co (j $\geq$ 25)')

names = ['K', 'L', 'r', 'w', 'τ', 'D', 'G']

for i in range(len(names)):

i_var = i + 3

i_axes = i + 2

row_i = i_axes // 3

col_i = i_axes % 3

axs[row_i, col_i].plot(paths[i_var])

axs[row_i, col_i].hlines(ss1[i_var], 0, T, color='r', linestyle='--')

axs[row_i, col_i].set_title(names[i])

# ylims

axs[1, 0].set_ylim([ss1[4]-0.1, ss1[4]+0.1])

axs[2, 2].set_ylim([ss1[9]-0.1, ss1[9]+0.1])

plt.show()

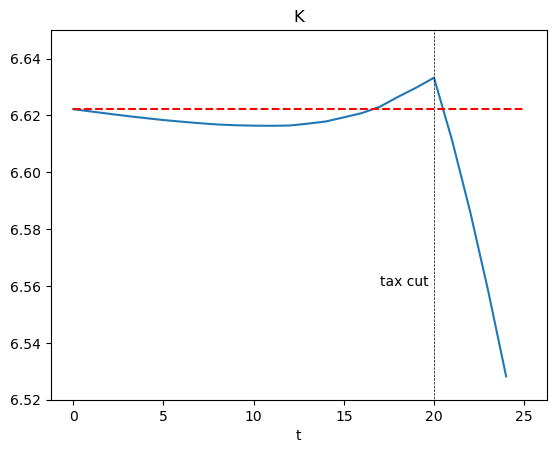

Notice how prices and quantities respond immediately to the anticipated tax rate increase.

Let’s zoom in on how the capital stock responds.

# K

i_var = 3

plt.plot(paths[i_var][:25])

plt.hlines(ss1[i_var], 0, 25, color='r', linestyle='--')

plt.vlines(20, 6, 7, color='k', linestyle='--', linewidth=0.5)

plt.text(17, 6.56, r'tax cut')

plt.ylim([6.52, 6.65])

plt.title("K")

plt.xlabel("t")

plt.show()

After the tax cut policy is implemented at \(t=20\), the aggregate capital will decrease because of the crowding out effect.

Having foreseen an increase in the interest rate, individuals a few periods before \(t=20\) start saving more.

Because that increases the capital, a temporary decrease in the interest rate ensues.

For agents living in much earlier periods, that lower interest rate causes them to save less.

We can also plot evolutions of means and variances of consumption by different cohorts along a transition path.

Cmean_seq = np.empty((T, J))

Cvar_seq = np.empty((T, J))

for t in range(T):

ap = hh.a_grid[σ_seq[t]]

δ = δ_seq[t].reshape((hh.j_grid.size, 1, 1))

inc = (1 + r_seq[t]*(1-τ_seq[t])) * a + (1-τ_seq[t]) * w_seq[t] * lj * γ - δ

inc = inc.reshape((hh.j_grid.size, hh.a_grid.size * hh.γ_grid.size))

c = inc - ap

Cmean_seq[t] = (c * μ_seq[t]).sum(axis=1)

Cvar_seq[t] = (

(c - Cmean_seq[t].reshape((J, 1))) ** 2 * μ_seq[t]).sum(axis=1)

J_seq, T_range = np.meshgrid(np.arange(J), np.arange(T))

fig = plt.figure(figsize=[20, 20])

# Plot the consumption mean over age and time

ax1 = fig.add_subplot(121, projection='3d')

ax1.plot_surface(T_range, J_seq, Cmean_seq, rstride=1, cstride=1,

cmap='viridis', edgecolor='none')

ax1.set_title(r"Mean of consumption")

ax1.set_xlabel(r"t")

ax1.set_ylabel(r"j")

# Plot the consumption variance over age and time

ax2 = fig.add_subplot(122, projection='3d')

ax2.plot_surface(T_range, J_seq, Cvar_seq, rstride=1, cstride=1,

cmap='viridis', edgecolor='none')

ax2.set_title(r"Variance of consumption")

ax2.set_xlabel(r"t")

ax2.set_ylabel(r"j")

plt.show()