7. Using Newton’s Method to Solve Economic Models#

GPU

This lecture was built using a machine with access to a GPU — although it will also run without one.

Google Colab has a free tier with GPUs that you can access as follows:

Click on the “play” icon top right

Select Colab

Set the runtime environment to include a GPU

7.1. Overview#

Many economic problems involve finding fixed points or zeros (also called “roots”) of functions.

For example, in a simple supply and demand model, an equilibrium price is one that makes excess demand zero.

In other words, an equilibrium is a zero of the excess demand function.

There are various computational techniques for solving for fixed points and zeros.

In this lecture we study an important gradient-based technique called Newton’s method.

Newton’s method does not always work but, in situations where it does, convergence is often fast when compared to other methods.

The lecture will apply Newton’s method in one-dimensional and multidimensional settings to solve fixed-point and zero-finding problems.

When finding the fixed point of a function \(f\), Newton’s method updates an existing guess of the fixed point by solving for the fixed point of a linear approximation to the function \(f\).

When finding the zero of a function \(f\), Newton’s method updates an existing guess by solving for the zero of a linear approximation to the function \(f\).

To build intuition, we first consider an easy, one-dimensional fixed point problem where we know the solution and solve it using both successive approximation and Newton’s method.

Then we apply Newton’s method to multidimensional settings to solve for market equilibria with multiple goods.

At the end of the lecture, we leverage the power of automatic

differentiation in jax to solve a very high-dimensional equilibrium problem.

We use the following imports in this lecture

import matplotlib.pyplot as plt

from typing import NamedTuple

from scipy.optimize import root

import jax.numpy as jnp

import jax

# Enable 64-bit precision

jax.config.update("jax_enable_x64", True)

7.2. Fixed point computation using Newton’s method#

In this section we solve the fixed point of the law of motion for capital in the setting of the Solow growth model.

We will inspect the fixed point visually, solve it by successive approximation, and then apply Newton’s method to achieve faster convergence.

7.2.1. The Solow model#

In the Solow growth model, assuming Cobb-Douglas production technology and zero population growth, the law of motion for capital is

Here

\(k_t\) is capital stock per worker,

\(A, \alpha>0\) are production parameters with \(\alpha < 1\)

\(s>0\) is a savings rate, and

\(\delta \in(0,1)\) is a rate of depreciation

In this example, we wish to calculate the unique strictly positive fixed point of \(g\), the law of motion for capital.

In other words, we seek a \(k^* > 0\) such that \(g(k^*) = k^*\).

Such a \(k^*\) is called a steady state, since \(k_t = k^*\) implies \(k_{t+1} = k^*\).

Using pencil and paper to solve \(g(k) = k\), you will be able to confirm that

7.2.2. Implementation#

Let’s store our parameters in NamedTuple to help us keep our code clean and concise.

class SolowParameters(NamedTuple):

A: float

s: float

α: float

δ: float

This function creates a suitable SolowParameters with default parameter values.

def create_solow_params(A=2.0, s=0.3, α=0.3, δ=0.4):

"""Creates a Solow model parameterization with default values."""

return SolowParameters(A=A, s=s, α=α, δ=δ)

The next two functions implement the law of motion (7.1) and store the true fixed point \(k^*\).

def g(k, params):

A, s, α, δ = params

return A * s * k**α + (1 - δ) * k

def exact_fixed_point(params):

A, s, α, δ = params

return ((s * A) / δ) ** (1 / (1 - α))

Here is a function to provide a 45 degree plot of the dynamics.

def plot_45(params, ax, fontsize=14):

k_min, k_max = 0.0, 3.0

k_grid = jnp.linspace(k_min, k_max, 1200)

# Plot the functions

lb = r"$g(k) = sAk^{\alpha} + (1 - \delta)k$"

ax.plot(k_grid, g(k_grid, params), lw=2, alpha=0.6, label=lb)

ax.plot(k_grid, k_grid, "k--", lw=1, alpha=0.7, label="45")

# Show and annotate the fixed point

kstar = exact_fixed_point(params)

fps = (kstar,)

ax.plot(fps, fps, "go", ms=10, alpha=0.6)

ax.annotate(

r"$k^* = (sA / \delta)^{\frac{1}{1-\alpha}}$",

xy=(kstar, kstar),

xycoords="data",

xytext=(20, -20),

textcoords="offset points",

fontsize=fontsize,

)

ax.legend(loc="upper left", frameon=False, fontsize=fontsize)

ax.set_yticks((0, 1, 2, 3))

ax.set_yticklabels((0.0, 1.0, 2.0, 3.0), fontsize=fontsize)

ax.set_ylim(0, 3)

ax.set_xlabel("$k_t$", fontsize=fontsize)

ax.set_ylabel("$k_{t+1}$", fontsize=fontsize)

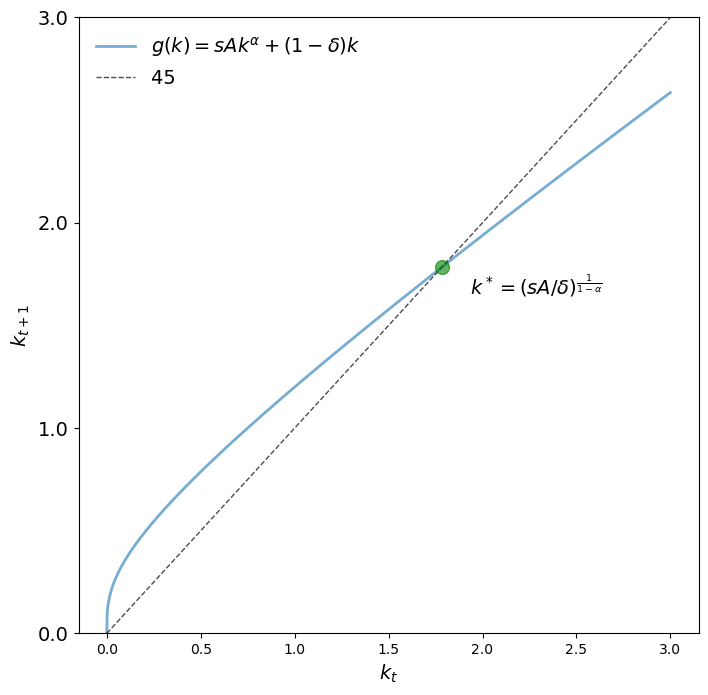

Let’s look at the 45 degree diagram for two parameterizations.

params = create_solow_params()

fig, ax = plt.subplots(figsize=(8, 8))

plot_45(params, ax)

plt.show()

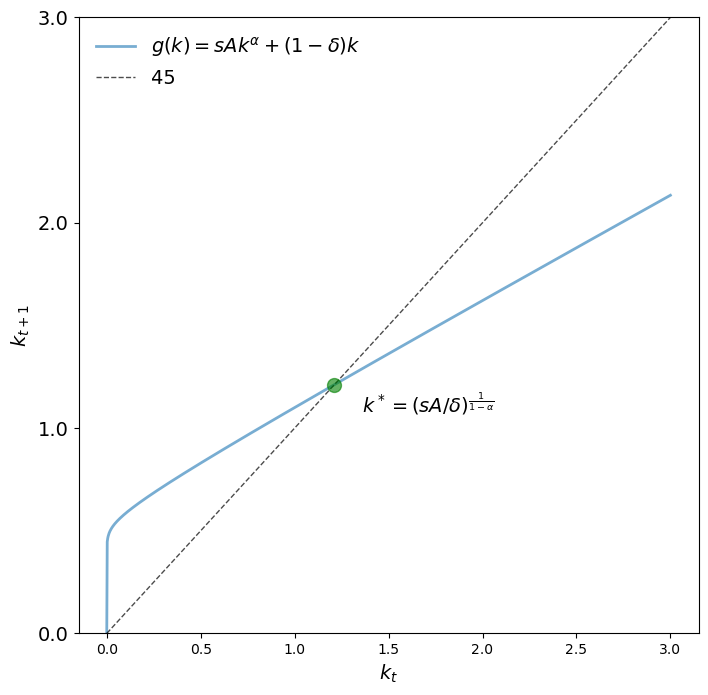

params = create_solow_params(α=0.05, δ=0.5)

fig, ax = plt.subplots(figsize=(8, 8))

plot_45(params, ax)

plt.show()

We see that \(k^*\) is indeed the unique positive fixed point.

7.2.2.1. Successive approximation#

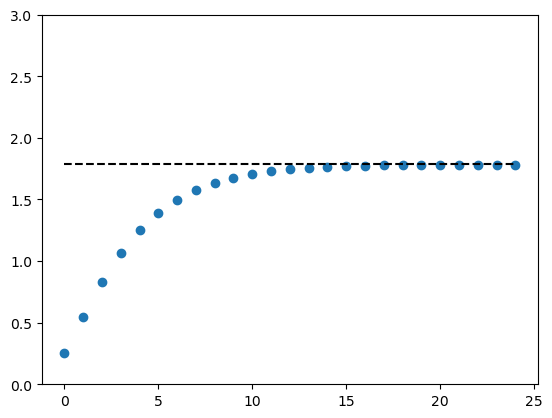

First let’s compute the fixed point using successive approximation.

In this case, successive approximation means repeatedly updating capital from some initial state \(k_0\) using the law of motion.

Here’s a time series from a particular choice of \(k_0\).

def compute_iterates(k_0, f, params, n=25):

"""Compute time series of length n generated by function f."""

k = k_0

k_iterates = []

for t in range(n):

k_iterates.append(k)

k = f(k, params)

return k_iterates

params = create_solow_params()

k_0 = 0.25

k_series = compute_iterates(k_0, g, params)

k_star = exact_fixed_point(params)

fig, ax = plt.subplots()

ax.plot(k_series, "o")

ax.plot([k_star] * len(k_series), "k--")

ax.set_ylim(0, 3)

plt.show()

Let’s see the output for a long time series.

k_series = compute_iterates(k_0, g, params, n=10_000)

k_star_approx = k_series[-1]

k_star_approx

1.7846741842265788

This is close to the true value.

k_star

1.7846741842265788

7.2.2.2. Newton’s method#

In general, when applying Newton’s fixed point method to some function \(g\), we start with a guess \(x_0\) of the fixed point and then update by solving for the fixed point of a tangent line at \(x_0\).

To begin with, we recall that the first-order approximation of \(g\) at \(x_0\) (i.e., the first order Taylor approximation of \(g\) at \(x_0\)) is the function

We solve for the fixed point of \(\hat g\) by calculating the \(x_1\) that solves

Generalising the process above, Newton’s fixed point method iterates on

To implement Newton’s method we observe that the derivative of the law of motion for capital (7.1) is

Let’s define this:

def Dg(k, params):

A, s, α, δ = params

return α * A * s * k ** (α - 1) + (1 - δ)

Here’s a function \(q\) representing (7.3).

def q(k, params):

return (g(k, params) - Dg(k, params) * k) / (1 - Dg(k, params))

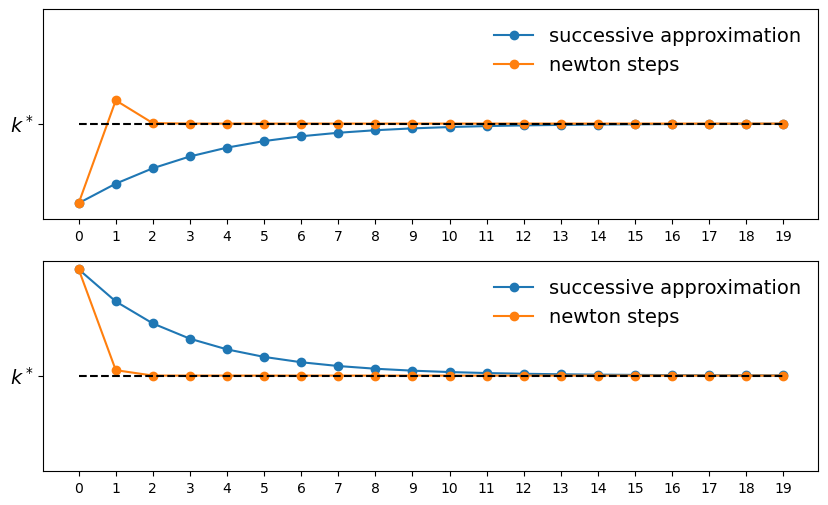

Now let’s plot some trajectories.

def plot_trajectories(

params,

k0_a=0.8, # first initial condition

k0_b=3.1, # second initial condition

n=20, # length of time series

fs=14, # fontsize

):

fig, axes = plt.subplots(2, 1, figsize=(10, 6))

ax1, ax2 = axes

ks1 = compute_iterates(k0_a, g, params, n)

ax1.plot(ks1, "-o", label="successive approximation")

ks2 = compute_iterates(k0_b, g, params, n)

ax2.plot(ks2, "-o", label="successive approximation")

ks3 = compute_iterates(k0_a, q, params, n)

ax1.plot(ks3, "-o", label="newton steps")

ks4 = compute_iterates(k0_b, q, params, n)

ax2.plot(ks4, "-o", label="newton steps")

for ax in axes:

ax.plot(k_star * jnp.ones(n), "k--")

ax.legend(fontsize=fs, frameon=False)

ax.set_ylim(0.6, 3.2)

ax.set_yticks((k_star,))

ax.set_yticklabels(("$k^*$",), fontsize=fs)

ax.set_xticks(jnp.linspace(0, 19, 20))

plt.show()

params = create_solow_params()

plot_trajectories(params)

We can see that Newton’s method converges faster than successive approximation.

7.3. Root-Finding in one dimension#

In the previous section we computed fixed points.

In fact Newton’s method is more commonly associated with the problem of finding zeros of functions.

Let’s discuss this “root-finding” problem and then show how it is connected to the problem of finding fixed points.

7.3.1. Newton’s method for zeros#

Let’s suppose we want to find an \(x\) such that \(f(x) = 0\) for some smooth function \(f\) mapping real numbers to real numbers.

Suppose we have a guess \(x_0\) and we want to update it to a new point \(x_1\).

As a first step, we take the first-order approximation of \(f\) around \(x_0\):

Now we solve for the zero of \(\hat f\).

In particular, we set \(\hat{f}(x_1) = 0\) and solve for \(x_1\) to get

Generalizing the formula above, for one-dimensional zero-finding problems, Newton’s method iterates on

The following code implements the iteration (7.5)

def newton(f, x_0, tol=1e-7, max_iter=100_000):

x = x_0

Df = jax.grad(f)

# Implement the zero-finding formula

@jax.jit

def q(x):

return x - f(x) / Df(x)

error = tol + 1

n = 0

while error > tol:

n += 1

if n > max_iter:

raise Exception("Max iteration reached without convergence")

y = q(x)

error = jnp.abs(x - y)

x = y

print(f"iteration {n}, error = {error:.5f}")

return x.item()

Numerous libraries implement Newton’s method in one dimension, including SciPy, so the code is just for illustrative purposes.

(That said, when we want to apply Newton’s method using techniques such as automatic differentiation or GPU acceleration, it will be helpful to know how to implement Newton’s method ourselves.)

7.3.2. Application to finding fixed points#

Now consider again the Solow fixed-point calculation, where we solve for \(k\) satisfying \(g(k) = k\).

We can convert to this to a zero-finding problem by setting \(f(x) := g(x) - x\).

Any zero of \(f\) is clearly a fixed point of \(g\).

Let’s apply this idea to the Solow problem

params = create_solow_params()

k_star_approx_newton = newton(f = lambda x: g(x, params) - x, x_0=0.8)

iteration 1, error = 1.27209

iteration 2, error = 0.28180

iteration 3, error = 0.00561

iteration 4, error = 0.00000

iteration 5, error = 0.00000

k_star_approx_newton

1.7846741842265788

The result confirms convergence we saw in the graphs above: a very accurate result is reached with only 5 iterations.

7.4. Multivariate Newton’s method#

In this section, we introduce a two-good problem, present a

visualization of the problem, and solve for the equilibrium of the two-good market

using both a zero finder in SciPy and Newton’s method.

We then expand the idea to a larger market with 5,000 goods and compare the performance of the two methods again.

We will see a significant performance gain when using Newton’s method.

7.4.1. A two-goods market equilibrium#

Let’s start by computing the market equilibrium of a two-good problem.

We consider a market for two related products, good 0 and good 1, with price vector \(p = (p_0, p_1)\)

Supply of good \(i\) at price \(p\) is

Demand of good \(i\) at price \(p\) is

Here \(c_i\), \(b_i\) and \(a_{ij}\) are parameters.

For example, the two goods might be computer components that are typically used together, in which case they are complements. Hence demand depends on the price of both components.

The excess demand function is

An equilibrium price vector \(p^*\) satisfies \(e_i(p^*) = 0\).

We set

for this particular question.

7.4.1.1. A graphical exploration#

Since our problem is only two-dimensional, we can use graphical analysis to visualize and help understand the problem.

Our first step is to define the excess demand function

The function below calculates the excess demand for given parameters

@jax.jit

def e(p, A, b, c):

return jnp.exp(-A @ p) + c - b * jnp.sqrt(p)

Our default parameter values will be

A = jnp.array([[0.5, 0.4], [0.8, 0.2]])

b = jnp.ones(2)

c = jnp.ones(2)

At a price level of \(p = (1, 0.5)\), the excess demand is

p = jnp.array([1, 0.5])

ex_demand = e(p, A, b, c)

print(

f"The excess demand for good 0 is {ex_demand[0]:.3f} \n"

f"The excess demand for good 1 is {ex_demand[1]:.3f}"

)

The excess demand for good 0 is 0.497

The excess demand for good 1 is 0.699

To increase the efficiency of computation, we will use the power of vectorization using jax.vmap. This is much faster than the python loops.

# Create vectorization on the first axis of p.

e_vectorized_p_1 = jax.vmap(e, in_axes=(0, None, None, None))

# Create vectorization on the second axis of p.

e_vectorized = jax.vmap(e_vectorized_p_1, in_axes=(0, None, None, None))

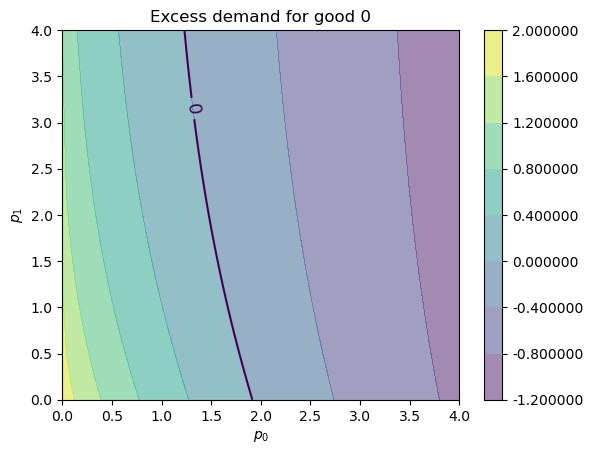

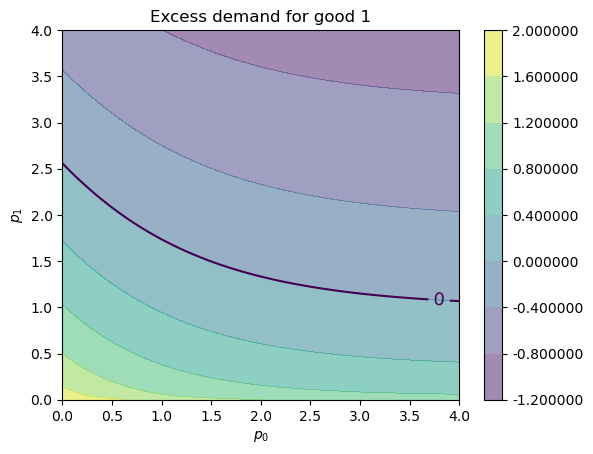

Next we plot the two functions \(e_0\) and \(e_1\) on a grid of \((p_0, p_1)\) values, using contour surfaces and lines.

We will use the following function to build the contour plots

def plot_excess_demand(ax, good=0, grid_size=100, grid_max=4, surface=True):

p_grid = jnp.linspace(0, grid_max, grid_size)

# Create meshgrid for all combinations of p_1 and p_2

P1, P2 = jnp.meshgrid(p_grid, p_grid, indexing="ij")

# Stack to create array of shape (grid_size, grid_size, 2)

P = jnp.stack([P1, P2], axis=-1)

# Compute all values at once using vectorized function

z_full = e_vectorized(P, A, b, c)

z = z_full[:, :, good]

if surface:

cs1 = ax.contourf(p_grid, p_grid, z.T, alpha=0.5)

plt.colorbar(cs1, ax=ax, format="%.6f")

ctr1 = ax.contour(p_grid, p_grid, z.T, levels=[0.0])

ax.set_xlabel("$p_0$")

ax.set_ylabel("$p_1$")

ax.set_title(f"Excess demand for good {good}")

plt.clabel(ctr1, inline=1, fontsize=13)

Here’s our plot of \(e_0\):

fig, ax = plt.subplots()

plot_excess_demand(ax, good=0)

plt.show()

Here’s our plot of \(e_1\):

fig, ax = plt.subplots()

plot_excess_demand(ax, good=1)

plt.show()

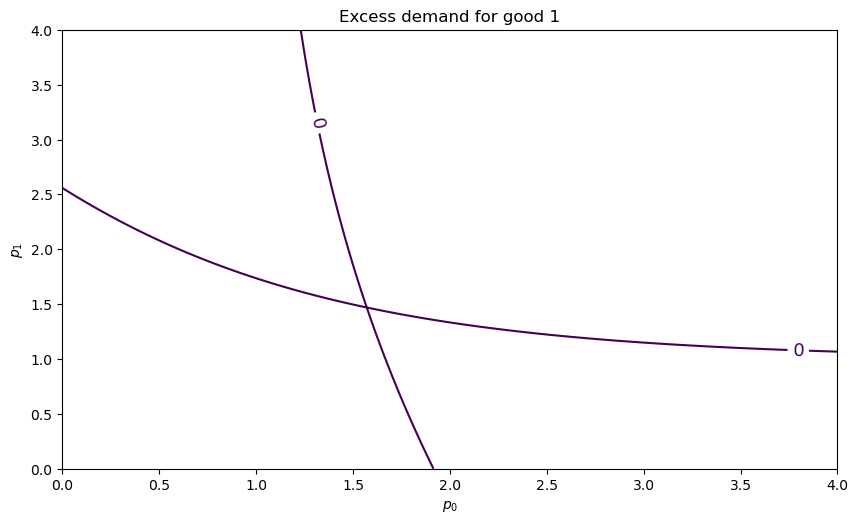

We see the black contour line of zero, which tells us when \(e_i(p) = 0\).

For a price vector \(p\) such that \(e_i(p) = 0\) we know that good \(i\) is in equilibrium (demand equals supply).

If these two contour lines cross at some price vector \(p^*\), then \(p^*\) is an equilibrium price vector.

fig, ax = plt.subplots(figsize=(10, 5.7))

for good in (0, 1):

plot_excess_demand(ax, good=good, surface=False)

plt.show()

It seems there is an equilibrium close to \(p = (1.6, 1.5)\).

7.4.1.2. Using a multidimensional root finder#

To solve for \(p^*\) more precisely, we use a zero-finding algorithm from scipy.optimize.

We supply \(p = (1, 1)\) as our initial guess.

init_p = jnp.ones(2)

This uses the modified Powell method to find the zero

%%time

solution = root(lambda p: e(p, A, b, c), init_p, method="hybr")

CPU times: user 5.18 ms, sys: 2.47 ms, total: 7.65 ms

Wall time: 4.43 ms

Here’s the resulting value:

p = solution.x

p

array([1.57080182, 1.46928838])

This looks close to our guess from observing the figure. We can plug it back into \(e\) to test that \(e(p) \approx 0\):

e_p = jnp.max(jnp.abs(e(p, A, b, c)))

e_p.item()

2.0383694732117874e-13

This is indeed a very small error.

7.4.1.3. Adding gradient information#

In many cases, for zero-finding algorithms applied to smooth functions, supplying the Jacobian of the function leads to better convergence properties.

Here, we manually calculate the elements of the Jacobian

def jacobian_e(p, A, b, c):

p_0, p_1 = p

a_00, a_01 = A[0, :]

a_10, a_11 = A[1, :]

j_00 = -a_00 * jnp.exp(-a_00 * p_0) - (b[0] / 2) * p_0 ** (-1 / 2)

j_01 = -a_01 * jnp.exp(-a_01 * p_1)

j_10 = -a_10 * jnp.exp(-a_10 * p_0)

j_11 = -a_11 * jnp.exp(-a_11 * p_1) - (b[1] / 2) * p_1 ** (-1 / 2)

J = [[j_00, j_01], [j_10, j_11]]

return jnp.array(J)

%%time

solution = root(

lambda p: e(p, A, b, c),

init_p,

jac = lambda p: jacobian_e(p, A, b, c),

method="hybr",

)

CPU times: user 263 ms, sys: 19.9 ms, total: 283 ms

Wall time: 399 ms

Now the solution is even more accurate (although, in this low-dimensional problem, the difference is quite small):

p = solution.x

e_p = jnp.max(jnp.abs(e(p, A, b, c)))

e_p.item()

1.3322676295501878e-15

7.4.1.4. Using Newton’s method#

Now let’s use Newton’s method to compute the equilibrium price using the multivariate version of Newton’s method

This is a multivariate version of (7.5)

(Here \(J_e(p_n)\) is the Jacobian of \(e\) evaluated at \(p_n\).)

The iteration starts from some initial guess of the price vector \(p_0\).

Here, instead of coding Jacobian by hand, we use the jacobian() function in the jax library to auto-differentiate and calculate the Jacobian.

With only slight modification, we can generalize our previous attempt to multidimensional problems

def newton(f, x_0, tol=1e-5, max_iter=10):

x = x_0

f_jac = jax.jacobian(f)

@jax.jit

def q(x):

return x - jnp.linalg.solve(f_jac(x), f(x))

error = tol + 1

n = 0

while error > tol:

n += 1

if n > max_iter:

raise Exception("Max iteration reached without convergence")

y = q(x)

if any(jnp.isnan(y)):

raise Exception("Solution not found with NaN generated")

error = jnp.linalg.norm(x - y)

x = y

print(f"iteration {n}, error = {error:.5f}")

print("\n" + f"Result = {x} \n")

return x

We find the algorithm terminates in 4 steps

%%time

p = newton(lambda p: e(p, A, b, c), init_p)

iteration 1, error = 0.62515

iteration 2, error = 0.11152

iteration 3, error = 0.00258

iteration 4, error = 0.00000

Result = [1.57080182 1.46928838]

CPU times: user 346 ms, sys: 17.2 ms, total: 363 ms

Wall time: 459 ms

e_p = jnp.max(jnp.abs(e(p, A, b, c)))

e_p.item()

1.4632739464559563e-13

The result is very accurate.

With the larger overhead, the speed is not better than the optimized scipy function.

7.4.2. A high-dimensional problem#

Our next step is to investigate a large market with 3,000 goods.

The excess demand function is essentially the same, but now the matrix \(A\) is \(3000 \times 3000\) and the parameter vectors \(b\) and \(c\) are \(3000 \times 1\).

dim = 3000

# Create JAX random key

key = jax.random.PRNGKey(0)

# Create a random matrix A and normalize the columns to sum to one

A = jax.random.uniform(key, (dim, dim))

s = jnp.sum(A, axis=0)

A = A / s

# Set up b and c

b = jnp.ones(dim)

c = jnp.ones(dim)

Here’s our initial condition

init_p = jnp.ones(dim)

%%time

p = newton(lambda p: e(p, A, b, c), init_p)

iteration 1, error = 23.22262

iteration 2, error = 3.94537

iteration 3, error = 0.08500

iteration 4, error = 0.00004

iteration 5, error = 0.00000

Result = [1.50723773 1.51041603 1.50134795 ... 1.49941629 1.49033692 1.49666807]

CPU times: user 7.75 s, sys: 1.89 s, total: 9.63 s

Wall time: 9.27 s

e_p = jnp.max(jnp.abs(e(p, A, b, c)))

e_p.item()

4.440892098500626e-16

With the same tolerance, we compare the runtime and accuracy of Newton’s method to SciPy’s root function

%%time

solution = root(

lambda p: e(p, A, b, c),

init_p,

jac = lambda p: jax.jacobian(e)(p, A, b, c),

method="hybr",

tol=1e-5,

)

CPU times: user 36.5 s, sys: 110 ms, total: 36.7 s

Wall time: 37.1 s

p = solution.x

e_p = jnp.max(jnp.abs(e(p, A, b, c)))

e_p.item()

9.209231102147442e-07

7.5. Exercises#

Exercise 7.1

Consider a three-dimensional extension of the Solow fixed point problem with

As before the law of motion is

However, \(k_t\) is now a \(3 \times 1\) vector.

Solve for the fixed point using Newton’s method with the following initial values:

Hint

The computation of the fixed point is equivalent to computing \(k^*\) such that \(g(k^*) - k^* = 0\).

If you are unsure about your solution, you can start with the solved example:

with \(s = 0.3\), \(\alpha = 0.3\), and \(\delta = 0.4\) and starting value:

The result should converge to the analytical solution.

Solution

Let’s first define the parameters for this problem

A = jnp.array([[2.0, 3.0, 3.0], [2.0, 4.0, 2.0], [1.0, 5.0, 1.0]])

s = 0.2

α = 0.5

δ = 0.8

initLs = [jnp.ones(3), jnp.array([3.0, 5.0, 5.0]), jnp.repeat(50.0, 3)]

Then define the multivariate version of the formula for the (7.1)

@jax.jit

def multivariate_solow(k, A=A, s=s, α=α, δ=δ):

return s * jnp.dot(A, k**α) + (1 - δ) * k

Let’s run through each starting value and see the output

attempt = 1

for init in initLs:

print(f'Attempt {attempt}: Starting value is {init} \n')

%time k = newton(lambda k: multivariate_solow(k) - k, \

init)

print('-'*64)

attempt += 1

Attempt 1: Starting value is [1. 1. 1.]

iteration 1, error = 50.49630

iteration 2, error = 41.10937

iteration 3, error = 4.29413

iteration 4, error = 0.38543

iteration 5, error = 0.00544

iteration 6, error = 0.00000

Result = [3.84058108 3.87071771 3.41091933]

CPU times: user 321 ms, sys: 17 ms, total: 338 ms

Wall time: 415 ms

----------------------------------------------------------------

Attempt 2: Starting value is [3. 5. 5.]

iteration 1, error = 2.07011

iteration 2, error = 0.12642

iteration 3, error = 0.00060

iteration 4, error = 0.00000

Result = [3.84058108 3.87071771 3.41091933]

CPU times: user 123 ms, sys: 2.49 ms, total: 126 ms

Wall time: 139 ms

----------------------------------------------------------------

Attempt 3: Starting value is [50. 50. 50.]

iteration 1, error = 73.00943

iteration 2, error = 6.49379

iteration 3, error = 0.68070

iteration 4, error = 0.01620

iteration 5, error = 0.00001

iteration 6, error = 0.00000

Result = [3.84058108 3.87071771 3.41091933]

CPU times: user 277 ms, sys: 15.4 ms, total: 292 ms

Wall time: 332 ms

----------------------------------------------------------------

We find that the results are invariant to the starting values given the well-defined property of this question.

But the number of iterations it takes to converge is dependent on the starting values.

Let’s substitute the output back into the formula to check our last result

multivariate_solow(k) - k

Array([0., 0., 0.], dtype=float64)

Note the error is very small.

We can also test our results on the known solution

A = jnp.array([[2.0, 0.0, 0.0], [0.0, 2.0, 0.0], [0.0, 0.0, 2.0]])

s = 0.3

α = 0.3

δ = 0.4

init = jnp.repeat(1.0, 3)

%%time

k = newton(lambda k: multivariate_solow(k, A=A, s=s, α=α, δ=δ) - k, init)

iteration 1, error = 1.57459

iteration 2, error = 0.21345

iteration 3, error = 0.00205

iteration 4, error = 0.00000

Result = [1.78467418 1.78467418 1.78467418]

CPU times: user 275 ms, sys: 12.9 ms, total: 288 ms

Wall time: 329 ms

The result is very close to the ground truth but still slightly different.

%%time

k = newton(

lambda k: multivariate_solow(k, A=A, s=s, α=α, δ=δ) - k, init, tol=1e-7

)

iteration 1, error = 1.57459

iteration 2, error = 0.21345

iteration 3, error = 0.00205

iteration 4, error = 0.00000

iteration 5, error = 0.00000

Result = [1.78467418 1.78467418 1.78467418]

CPU times: user 249 ms, sys: 7.68 ms, total: 256 ms

Wall time: 283 ms

We can see it steps towards a more accurate solution.

Exercise 7.2

In this exercise, let’s try different initial values and check how Newton’s method responds to different starting points.

Let’s define a three-good problem with the following default values:

For this exercise, use the following extreme price vectors as initial values:

Set the tolerance to \(1e-15\) for more accurate output.

Solution

Define parameters and initial values

A = jnp.array([[0.2, 0.1, 0.7], [0.3, 0.2, 0.5], [0.1, 0.8, 0.1]])

b = jnp.array([1.0, 1.0, 1.0])

c = jnp.array([1.0, 1.0, 1.0])

initLs = [jnp.repeat(5.0, 3), jnp.ones(3), jnp.array([4.5, 0.1, 4.0])]

Let’s run through each initial guess and check the output

for attempt, init in enumerate(initLs, start=1):

print(f"Attempt {attempt}: Starting value is {init} \n")

%time p = newton(lambda p: e(p, A, b, c), init, tol=1e-15, max_iter=15)

print("-" * 64)

Attempt 1: Starting value is [5. 5. 5.]

iteration 1, error = 9.24381

CPU times: user 307 ms, sys: 11.4 ms, total: 318 ms

Wall time: 365 ms

---------------------------------------------------------------------------

Exception Traceback (most recent call last)

Cell In[51], line 3

1 for attempt, init in enumerate(initLs, start=1):

2 print(f"Attempt {attempt}: Starting value is {init} \n")

----> 3 get_ipython().run_line_magic('time', 'p = newton(lambda p: e(p, A, b, c), init, tol=1e-15, max_iter=15)')

4 print("-" * 64)

File ~/miniconda3/envs/quantecon/lib/python3.13/site-packages/IPython/core/interactiveshell.py:2504, in InteractiveShell.run_line_magic(self, magic_name, line, _stack_depth)

2502 kwargs['local_ns'] = self.get_local_scope(stack_depth)

2503 with self.builtin_trap:

-> 2504 result = fn(*args, **kwargs)

2506 # The code below prevents the output from being displayed

2507 # when using magics with decorator @output_can_be_silenced

2508 # when the last Python token in the expression is a ';'.

2509 if getattr(fn, magic.MAGIC_OUTPUT_CAN_BE_SILENCED, False):

File ~/miniconda3/envs/quantecon/lib/python3.13/site-packages/IPython/core/magics/execution.py:1452, in ExecutionMagics.time(self, line, cell, local_ns)

1450 if interrupt_occured:

1451 if exit_on_interrupt and captured_exception:

-> 1452 raise captured_exception

1453 return

1454 return out

File ~/miniconda3/envs/quantecon/lib/python3.13/site-packages/IPython/core/magics/execution.py:1416, in ExecutionMagics.time(self, line, cell, local_ns)

1414 st = clock2()

1415 try:

-> 1416 exec(code, glob, local_ns)

1417 out = None

1418 # multi-line %%time case

File <timed exec>:1

Cell In[34], line 17, in newton(f, x_0, tol, max_iter)

15 y = q(x)

16 if any(jnp.isnan(y)):

---> 17 raise Exception("Solution not found with NaN generated")

18 error = jnp.linalg.norm(x - y)

19 x = y

Exception: Solution not found with NaN generated

We can see that Newton’s method may fail for some starting values.

Sometimes it may take a few initial guesses to achieve convergence.

Substitute the result back to the formula to check our result using the second initial guess which converges

p_solution = newton(lambda p: e(p, A, b, c), initLs[1], tol=1e-15, max_iter=15)

e(p_solution, A, b, c)

iteration 1, error = 0.73419

iteration 2, error = 0.12472

iteration 3, error = 0.00269

iteration 4, error = 0.00000

iteration 5, error = 0.00000

iteration 6, error = 0.00000

Result = [1.49744442 1.49744442 1.49744442]

Array([0.00000000e+00, 0.00000000e+00, 2.22044605e-16], dtype=float64)

We can see the result is very accurate.